5 Essential Tips for Effective Airtable Expense Tracking

Getting Started with Airtable Expense Tracking

When it comes to managing your expenses, Airtable can be a game-changer. Whether you're tracking personal finances or business expenses, regular and accurate expense tracking is crucial for maintaining financial health. With Airtable, you can streamline the process and gain valuable insights into your spending habits.

One of the key benefits of using Airtable for expense tracking is its flexibility. You can easily customize the template to suit your specific needs and preferences. Additionally, Airtable offers features such as API integration for building iOS Shortcuts, which enables you to quickly add new expense records on the go.

By setting up your expense tracking using Airtable, you gain access to powerful tools for analyzing your spending patterns. With filter views and grouping options, you can effortlessly gain insights into specific categories or time periods.

1. Rely on Good Expense Tracking Templates

When it comes to effective airtable expense tracking, relying on good expense tracking templates can make a significant difference in managing your finances. Choosing the right template is crucial for ensuring that your expense tracking process is streamlined and efficient.

Choosing the Right Template

Selecting an Airtable expense tracking template that aligns with your specific needs is essential. Whether you're tracking personal expenses, business costs, or project-related spending, the template from Airtable Official is always the first choice. It offers customizable fields and intuitive organization can greatly enhance your tracking experience.

Inputting Your Initial Expenses

Once you've chosen the appropriate template, it's time to input your initial expenses into Airtable. Utilize categories to better organize your expenses, making it easier to identify and analyze spending patterns. By categorizing expenses such as groceries, utilities, entertainment, and transportation, you can gain a comprehensive overview of where your money is going.

Categories and Tags for Better Organization

Utilize categories within the expense tracking template to ensure that each expenditure is accurately classified. This level of organization allows for easy filtering and analysis based on specific spending categories.

2. Use iOS Shortcuts to Quickly Add Expense Records (Re-Check)

In addition to its robust features for expense tracking, Airtable offers seamless integration with iOS Shortcuts, providing a convenient way to quickly add new expense records on the go. This functionality enhances the efficiency of capturing expenses and ensures that no transaction goes unrecorded, you can even use Siri to create a record using voice!

Get Airtable Expense Tracking Shortcuts

To get the Shortcuts, you can join Airtable iOS Shortcuts Library which already includes this Shortcut with detailed Setup Instruction Video, plus you can also get access to other Airtable Shortcuts that help you Effortless Clipping Website, Text, and File to your base.

The Airtable API serves as a powerful tool for creating custom integrations tailored to your specific expense tracking needs. By leveraging the API, you can even develop personalized solutions based on the Shortcuts Library that automate certain aspects of expense tracking, further streamlining the process and increasing accuracy.

3. Customizing Your Expense Tracking Template

When it comes to airtable expense tracking, customizing your expense tracking template can significantly enhance your ability to manage and analyze your finances effectively. By adding custom fields for detailed tracking, you can capture specific information related to each expense, allowing for comprehensive analysis and insights.

Adding Custom Fields for Detailed Tracking

In order to ensure thorough tracking of your expenses, it's essential to include custom fields that capture key details. The existing fields in template include Date, Amount, Category, and Notes. The date field allows you to record the date of the expense, providing a chronological view of your spending patterns. The amount field captures the cost of the expense, enabling you to calculate total expenditures over specific periods. Categorizing expenses using the category field allows for easy grouping and analysis based on different spending categories. Additionally, you can include a notes field provides an opportunity to add specific details or context regarding each expenditure.

Using Formulas for Automatic Calculations

One of the benefits of utilizing Airtable for expense tracking is its ability to perform automatic calculations using formulas. By incorporating formulas into your expense tracking template, you can streamline the process of deriving valuable insights from your financial data. For example, you can create formulas to calculate total monthly expenses, average spending per category, or percentage allocation of funds towards different expenditure areas.

In addition to standard fields such as date and amount, leveraging formulas enables you to derive meaningful metrics that offer deeper understanding and analysis of your financial habits.

By customizing your expense tracking template with these additional fields and formulas, you can gain a more comprehensive view of your financial landscape while simplifying the process of capturing and analyzing expenses.

4. Analyzing Your Expense Data

Once you have diligently tracked your expenses using Airtable expense tracking, it's time to delve into the valuable insights that can be derived from your financial data. By analyzing your expense data, you can gain a comprehensive understanding of your spending patterns, identify areas for potential savings, and make informed decisions to optimize your financial management.

Creating Reports View Using GroupBy and Date Filter

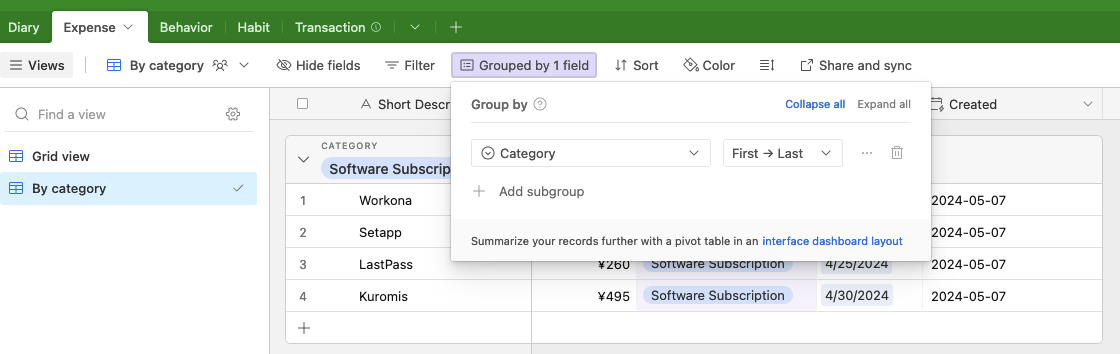

Airtable provides robust features for creating customized reports to analyze your expense data effectively. By utilizing the GroupBy and Date Filter functionalities within Airtable, you can generate insightful reports that offer a detailed breakdown of your expenditures. The GroupBy feature allows you to categorize expenses based on specific criteria such as categories or payment methods, providing a clear overview of where your money is being allocated. Additionally, the Date Filter enables you to narrow down the report to specific time periods, facilitating a comparative analysis of spending habits over different durations.

Identifying Spending Trends and Opportunities for Savings

Analyzing your expense data empowers you to identify recurring spending trends and pinpoint opportunities for cost-saving measures. By examining the generated view, you can discern patterns in your expenditure across various categories and timeframes. This insight allows you to make informed decisions about where adjustments can be made to optimize your budgeting and achieve greater financial efficiency.

Moreover, by identifying areas where expenses consistently exceed budgeted amounts or discovering unnecessary recurring costs, you can proactively implement strategies to reduce unnecessary expenditures and maximize savings.

5. Making the Most of Airtable for Expense Management

Regular Review and Update of Your Airtable Base

Consistent review and updates are essential for maintaining the accuracy and relevance of your Airtable expense tracking. Schedule regular intervals to review your expense records, ensuring that all entries are up to date and accurately reflect your financial transactions. By staying proactive in updating your Airtable base, you can rely on precise data when analyzing your spending patterns and making informed financial decisions.

Sharing Your Expense Tracker with Stakeholders

Sharing your expense tracker with stakeholders is a valuable practice for fostering transparency and collaboration in financial management, you can enable table view sharing to share your expense data.

Setting Permissions and Views

When sharing your Airtable expense tracker with stakeholders, it's crucial to establish appropriate permissions and views to control access levels. By defining specific permissions rule based email domain or password , you can ensure that stakeholders only have access to relevant sections of the expense tracker, safeguarding sensitive financial information while promoting collaborative transparency.

Collaborating on Budget Planning

Collaboration on budget planning within the Airtable expense tracking environment allows stakeholders to contribute insights, suggestions, and feedback towards optimizing financial strategies. By leveraging the collaborative capabilities of Airtable, you can engage stakeholders in meaningful discussions about budget allocation, expenditure prioritization, and long-term financial goals.